Supported a 10-fold Increase in Monthly Collections from Physical Therapy Worker’s Compensation Claims

Worker’s Comp Claims present unique challenges to billers and claims follow-up agents. By following the processes and guidelines outlined by the Payer, you can improve collections multi-fold.

ViewPoint

Accounts Receivable management processes require attention to detail, the ability to identify issues, and initiate strategies to improve collections. Worker’s Compensation claims, in particular, present unique challenges as these claims are processed manually by insurance companies. Follow-up effort on worker’s compensation claims are often futile and, therefore, billers and accounts receivable teams should work in synchrony to file claims as per guidelines and follow up with Insurance companies.

In this case study, we highlight how understanding the role of the adjusters in the Payer organization can be vital to improving collections.

Results Summary

Customer Situation

A leading physical therapy practice based in Staten Island was growing significantly. At the same time, they were losing revenue as they were getting minimal reimbursement for Worker's Compensation claims, and upon follow-up, the claims were not showing any status. At the time of commencement of relationship with Medical Billing Wholesalers, they were collecting less than $7K of Worker's Compensation claims in a month.

Since most of the claims had no status, we realized that the problem on hand required a careful examination of the situation and creating a scalable process to help the practice grow

Challenges with Workers Compensation Claims

Our A/R team resubmitted most of the Worker's compensation claims and, upon follow-up, failed to get any response. In most cases, we reached voice mails. We put a team in place to focus on resolving the issue and identified the following items:

No response received for Workers' compensation claims after submitting the claims to the carrier

Online portal access for providing Worker's Compensation claims not set up by the practice

Lack of proper benefit checking processes for Worker's compensation claims

No ERA/EFT setup for Workers' compensation to get electronic reimbursements

Delays in releasing the medical records by physician office

Solution

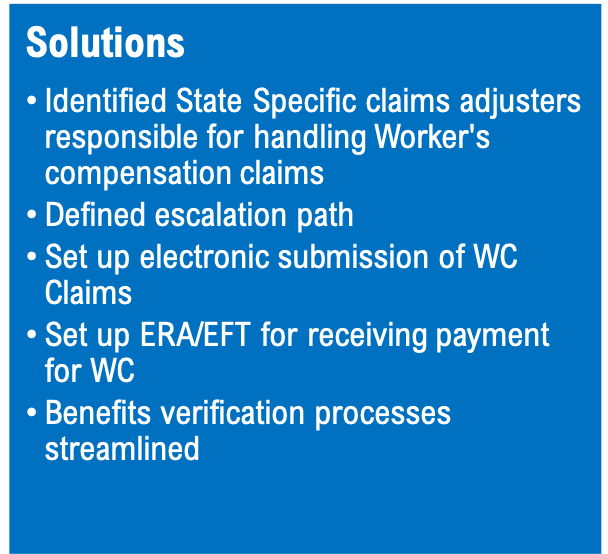

Setting up internal processes

Benefit Verification. By definition, the Worker's Compensation requires a fair amount of documentation and adherence to the guidelines. For proper checking eligibility and benefits, we ensured that we use designated forms to verify WC benefit requests.

Timely release of medical records. Physicians must release the medical records on time so that we can submit the claims on time and receive the payment.

Reaching out to Adjusters.

Identifying adjusters. We designated adjusters for Worker's Compensation claims for each city and obtained their information along with email ID. Based on the first letter of the Patient's first name, the designated adjuster can be identified. This information is usually available online for each city. For New York State Adjuster information, please click here.

Escalations. Post submission of claims to the adjusters, we did not receive any response in many cases. We escalated this to the supervisors of the adjuster using their email ID.

Online Claims Submission.

For each state, the online access for portals for submitting WC claims has to be created by the practice.

Online claims submission results in faster payments and enables the practice to get a quick check on the claim's status.

Receiving Payments.

A physician can set up the ERA/EFT via an online portal for WC. Once set up, we can get faster payments and also take on time action for the denial.

Results

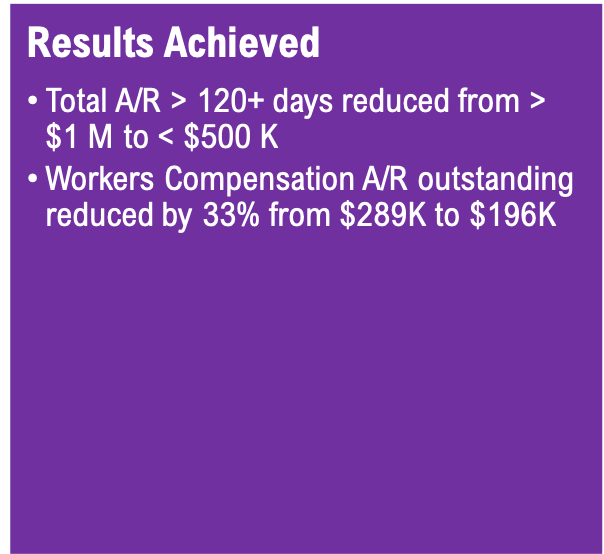

After we addressed these issues, the payments for the WC claims started coming. The average collections moved up from 21% of the billed amount to 45% of the invoiced amount.

We have reduced the outstanding AR in the 120+ day aging bucket from over $1 M to less than $500 K.

Electronic claims submission processes for Worker's Compensation led to an improvement in the time taken in getting a response

ERA/EFT set up ensured that the payments are received electronically

Clear processes for benefits verification and education of the practice team have resulted in a reduction in denial rates

Average Monthly Outstanding of Worker's compensation claims reduced by one-third from $286K to $196K.

Monthly Outstanding A/R - Workers Compensation Claims

Monthly Payment Receipts - Workers' Compensation Claims

Schedule a consultation

Managing denials requires focused efforts to identify and eliminate root causes, finding solutions, and creating scalable approaches. To learn about how we can help you reduce denials and improve revenue cycle metrics, please fill the form below and we will be in touch.