Case Study: Correct Coding and Electronic Submission of Podiatry Claims reduce denials by 23% and improves collection by 25%

Bad quality scanning of superbills and lack of adoption of electronic claims submission creates a charge backlog situation and consequently, result in increased denials on account to timely filing dates not being adhered to.

ViewPoint

When the complexity of revenue cycle management processes is increasing and reimbursements are declining each year, a provider must make good of every collectible dollar. Often, healthcare providers do not pay due attention to their revenue cycle processes and ignore the basics. Adoption of electronic claims submission is one such activity. Easy to implement yet a lot of providers do not set up electronic submission processes correctly. If healthcare providers do not attempt to understand the impact, they may have on charge entry processes, superbills can also create a lot of issues. A strong understanding of the provider’s medical specialty, common reasons for denials, and the understanding of the filing requirements different payers do accelerate your revenue cycle.

Results Summary

Customer Situation

Our client, a podiatry clinic, based in P.A focuses on helping athletes maintain foot and ankle health to effectively pursue their goals. Inaccurate diagnosis coding, lack of adherence to requirements of electronic submission for specific codes, lack of understanding of coding guidelines, incomplete information about referring providers were l causing a lot of payment issues resulting in revenue leakage of over 20%.

Challenges

Physicians need to be conscious of the impact the quality of clinical documentation can have on the revenue cycle.

Lack of proper scanning of charge files created a backlog situation with charge entry as these batches were held awaiting inputs from the physicians

Coding issues: Inappropriate coding caused the result in a higher denial rate.

The level of specificity was not given on the diagnosis codes that prevent the claims from submission.

Only four-digits were marked for the Cpt where most of the charges were kept on hold for provider assistance.

Lack of information on the referring provider caused the claims to be pended

The cumulative revenue impact of these issues was over a 25% reduction in revenue generated.

Solution

Medical Billing Wholesalers’ expertise in Podiatry and streamlining revenue cycle processes for healthcare providers manifests itself in the form of detailed checklists and playbooks. Our team applies technology, process rigor, and best practices to improve revenue cycle outcomes for our clients. Our approach involved the following:

Identified and collated the top issues impacting collections

Made charge entry backlog clearance a #1 priority for the team

Additional staffing to clear the backlog during the month-end period.

Aggregated coding issues shared with the client team as of issue logs, proposed solutions and educated the client team to fix the issues

Focused on clearing the issue logs with regular follow-up and ensured that charges are captured on time

Improved adoption of electronic claims submission instead of superbill submission to adhere to guidelines on electronic submission for specific claim types.

Timely Entry, Audit, and filing of Electronic claims helped to improve efficiency.

Eligibility Verification Before entering Charges and timely follow up with Patients to obtain accurate Insurance Information. This resulted in clean claims and a faster turn-around of payments.

Eligibility verification at the time of Service helped the practice to collect Co-pays immediately.

Result

Our efforts to create a collaborative process for issue identification, solution definition, and resolution were appreciated by the clinic’s team. With focused efforts we were able to bring about all-round improvements:

Helped the provider recognize the issues in clinical documentation and resolved coding issues

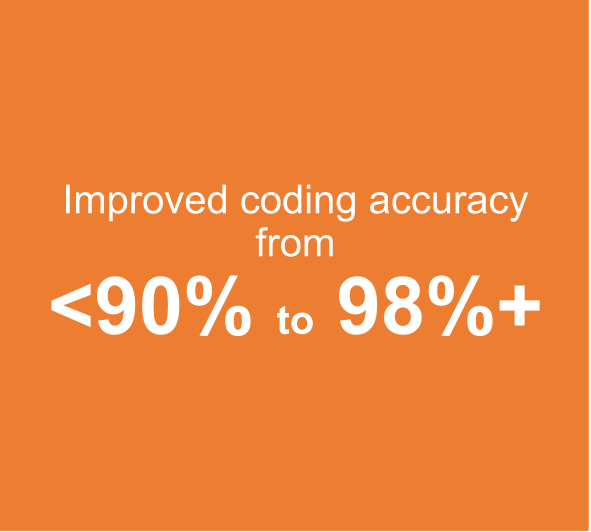

Improved coding accuracy from 90% to 98%

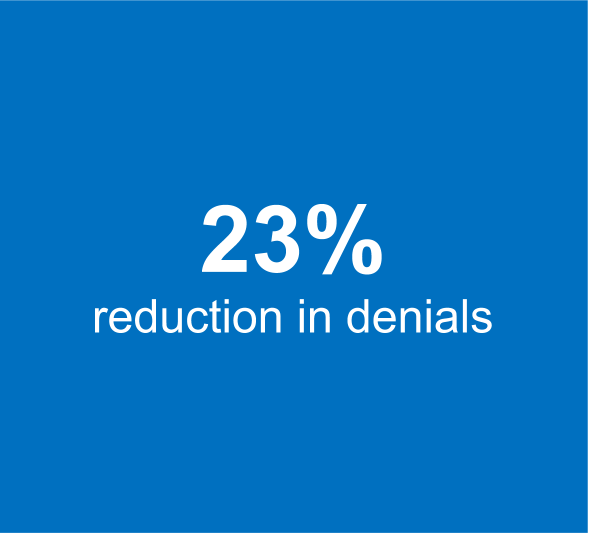

Denial rate was reduced from 30% to 7%

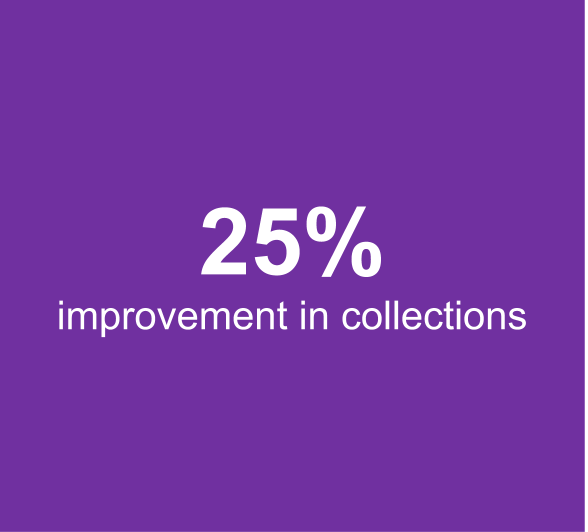

Improved collections by 25% i.e. from $33K in August 2018 to $42 K in Dec 2018

Fixed the charge volume fluctuations to create a steady flow of volumes and avoid month-end closure issues.

Schedule a consultation

Our focus on resolving denials by identifying and systemically eliminate the root causes, helps our clients improve revenue by a minimum of 20%. To learn about how we can help you reduce denials and improve revenue cycle metrics, please fill the form below, and we will be in touch.